Ever since Patagonia began making fleeces out of used soda bottles in the early 90s, the apparel industry has been slowly increasing its use of recycled polyester or rPET (recycled polyethylene terephthalate). This sounds like great news for the following reasons:

- The apparel industry is the second largest polluter and recycled polyester (rPET)is estimated to have 75% lower carbon footprint than virgin polyester

- Polyester accounts for nearly 50% of global fiber production

- AND we need an outlet for all the plastic bottles we consume. Yes, ideally we ban plastic completely, but the likelihood of this happening any time soon is LOW, given recent estimates that roughly half a trillion water bottles will be sold in 2020

However, rPET remains but a drop in the bucket compared with virgin polyester (8% of total PET production). Given its environmental benefits compared with virgin polyester, how do we increase its use?

The bulk of the apparel industry and its consumers still care most about cost. Unfortunately, while conscious consumerism and sustainability focused companies make headlines, they still represent the minority. With virgin polyester currently produced in much higher volumes than rPET and rPET having a geographically disparate and therefore expensive supply chain, virgin polyester remains cheaper. In order to increase rPET’s share of the polyester market it has to be at least cost competitive with virgin polyester while also being available in large quantities.

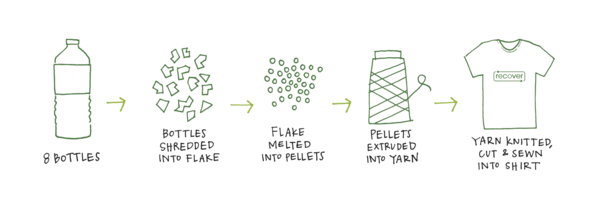

Recycled polyester (rPET) is produced largely from recycled plastic bottles and has virtually the same functionality as virgin PET, so designers don’t have to adapt their techniques to suit a completely new fiber. Established recycling infrastructure in the US (and other countries) collect used plastic bottles and export them to China where they are melted down into pellets from which new polyester fibers can be extruded and made into garments. With many brands contracting suppliers in China this causes little disruption to their production process and reduces their carbon footprint; although, it’s still more expensive than virgin PET.

Image Source: Recoverbrands.com

Seeing as China plays such an important role in rPET production, the recent decision by the Chinese government to ban 24 types of recycled material imports seems, at first glance, seems like a terrible thing for the growth of rPET. However, this may be an opportunity for the US to step in and develop its own production capacity and possibly help reduce rPET costs – all the while reshoring some of those manufacturing jobs it’s been lamenting losing.

Currently, China’s used materials ban has recyclers in the US scrambling to find a new market for a lot of the $5.6 billion of scrap commodities it used to export to China annually. While naturally in the short term this jeopardizes the growth of rPET as well as the stability of the US recycling industry, it also represents an amazing opportunity for the US to develop the domestic infrastructure to support processing of recycled plastics. With all the used plastic piling up throughout the US, the industry would have access to extremely cheap raw materials while, importantly, bringing back some manufacturing jobs. Brands may also then be incentivized to produce their clothes in the US if there were abundant, low cost rPET for them to use.

What’s more, as I mentioned previously, even before the ban the supply chain for rPET was geographically disparate (i.e. shipping from the US to China), which increased its carbon footprint and reduced its financial competitiveness vis-a-vis virgin polyester. By developing domestic infrastructure, not only would the US have cheap raw material inputs, but it would also avoid much of transportation cost that is currently factored into the material when sourced from China.

While the US can’t compete with China on labor costs, if it were to build this industry, it may be able to compete on raw material costs as plenty of recyclers are desperate to find a market to offload their mountains of used plastic bottles. Developing this domestic capacity may also catalyze other local markets for used plastic to grow and hopefully increase collection rates as only 23% of the roughly 50 billion plastic water bottles consumed in the US each year are estimated to be recycled.

While it is abundantly clear that the Trump Administration doesn’t care about the environmental benefits of recycling or the impact of the apparel industry, it does hate relying on China and constantly complains about the loss of manufacturing jobs overseas. China’s recycling ban has directly threatened the livelihoods of over 150,000 American recycling workers while exposing, again, our over reliance on it. By investing in increasing rPET’s use by developing domestic production capacity, the government could not only save thousands of recycling jobs while reshoring some manufacturing jobs, it could inadvertently make the apparel industry more sustainable. This could be their silver bullet… or (recycled) plastic pellet.