Throughout the weekend, television news coverage dwelled on Friday’s downgrade of U.S. debt securities by Standard and Poor’s, one of the three main ratings agencies that assess the creditworthiness of the federal government. The meaning of S & P’s action remains somewhat uncertain, and we doubt that, as important as the story was, the downgrade will have strong economic repercussions, provided that it is well understood.

In Sunday’s early print edition of the New York Times, Nelson Schwartz and Eric Dash reported that “…many analysts say the impact [on interest rates] could be modest, in part because the other ratings agencies, Moody’s and Fitch, have not downgraded the government at this time.”

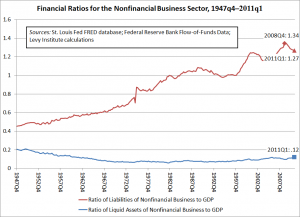

Indeed, yields on U.S. government debt instruments remained very low following the downgrade, after decreasing over the past few months. Investors seem unconvinced that the government could somehow fail to come up with the dollars it needed to meet its repayment and interest-payment commitments. Nonetheless, financial markets were jittery, if only because of the downgrade announcement itself.

Also, we remain convinced that there is no basis for a belief that the federal government will ever have to default on its debt. This statement applies to the United States or any other country with a sovereign currency and a floating exchange rate.

The real problem was probably a fear on the part of S & P that the government might not repay its debt, not that it could not. The debt level has been very high for a long time, but the S & P move did not occur before the near-stalemate over the debt limit. This was a real crisis. A failure to raise the ceiling might conceivably have led to a default. However, a U.S. government failure to pay interest or repay principal cannot occur, as long as national political leaders make it clear that they will permit routine debt issuance and money creation to continue.

What’s more, taxpayer advocates should be aware, as Ronald Reagan was, that the ability to run deficits conferred by a sovereign currency enhances the government’s powers to lower taxes as Congress and the President see fit. (As an aside, it follows that if all of the national governments in Europe had independent, unbacked currencies like the U.S. greenback, they could avoid the ineluctable defaults and ensuing austerity measures that come with a currency union, gold standard, or similar international system, though they would sacrifice the many advantages of a shared currency.)

It goes without saying that in any country, balance is required in decision-making about taxes and spending, bond issuance and money creation, and workers and corporations to go along with competing policy goals, such as low inflation, low unemployment, economic growth, income security, stability of the exchange rate, equity and the like. The U.S. government lost the mostly symbolic weight of its top S & P bond rating mostly because brinksmanship over the debt limit jeopardized its power to weigh these objectives and act upon them.

ShareThis

ShareThis