Man Cannot Live by Fed Alone

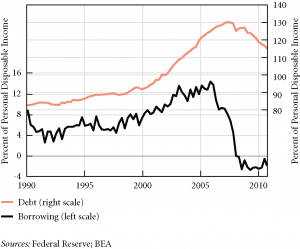

Over the past several decades, many people adopted the view that monetary policy, almost alone, could effectively control the economy. Economists, politicians and scholars came to believe that the Federal Reserve was full of neutral technocrats who dutifully fine-tuned the economy. Through their careful orchestration of interest rates, the money supply and inflation, we assumed that they could guarantee a smoothly functioning economy. Fed officials seemed to do so well at their jobs that they were never doubted. But by depending on monetary policy and discounting fiscal policy as an effective way to secure economic stability, we have created a system that is now dysfunctional.

Randall Wray and Micah Hauptman have a piece in The Hill on the problems with our over-reliance on the Federal Reserve. Due to the fact that fiscal policy is mired in political deadlock (more particularly, expansionary fiscal policy) we may be stuck relying on (inadequate) support from the Fed.

Wray recently wrote a policy brief with Scott Fullwiler (“It’s Time to Rein in the Fed”) that is relevant to this issue. From their one-pager (referring here to QE2): “…it’s truly remarkable that, three years into the crisis, the Fed still has not learned that monetary policy is about price, not quantity. The Fed is buying $600 billion in long-term Treasuries in the hope of bringing down the long-term rate. Yet, if it really understood monetary operations, the Fed would instead announce that it is standing ready to buy as many Treasuries as necessary in order to lower the long-term rate by a desired amount.”

ShareThis

ShareThis