Michael Stephens | June 14, 2012

The intensity of the debate over whether the Baltic economies (Estonia, Latvia, and Lithuania) should serve as models for the rest of the eurozone periphery has been raised a couple notches. Last week, Paul Krugman noted that the Estonian recovery, while positive, has not been as remarkable as austerity supporters tend to imply. This prompted a vigorous reaction from Estonia’s head of state (unless there’s someone impersonating Toomas Hendrik Ilves on Twitter). But let’s bracket for the moment this question of how impressive the Baltic recoveries have been. They are growing again, and that’s at least something. Last week, Rainer Kattel and Ringa Raudla put out a policy note that focused on a different aspect of the problem: whatever you think of the results, to what extent is the Baltic experience replicable? If the rest of the eurozone periphery can’t reproduce the conditions that led to Baltic growth, then this isn’t a terribly useful model.

The argument is supposed to be that austerity and internal devaluation (that’s basically trying to get your real wages to fall in order to regain competitiveness) should be credited for the recoveries in the Baltics (incomplete though they may be). As C. J. Polychroniou has been pointing out, the latest attempts at internal devaluation don’t appear to be working terribly well in the rest of the periphery. But perhaps if Greece and the rest of the GIPSI countries were to suck it up, bite down hard, or whatever is the tough love phrase of the day, they might come out on the other end with a Baltic-type recovery.

The problem with this argument, as Rainer Kattel and Ringa Raudla point out, is that there was very little actual “adjustment” in Estonia, Latvia, and Lithuania. The Baltic recoveries are largely attributable to economic factors that have little to do with austerity policies. The recoveries were largely “outsourced,” as Kattel and Raudla put it. First, the Baltic states have been relying on advanced use of EU structural support funding (as Kattel and Raudla note, a stunning 20 percent of Estonia’s budget is made up of EU funds), and second, Baltic exporters are deeply integrated with the Scandinavian and Polish economies, both of which weathered the crisis quite well. Finally, all of the Baltic economies have very flexible labor markets, accompanied by an usual amount of emigration—which is in part why (very high) unemployment rates have started to tick down. This is simply not a model that could be replicated periphery-wide.

Moreover, Kattel and Raudla provide reasons to believe that the “outsourced” Baltic recoveries are unsustainable. The whole thing is worth reading. A One-Pager version is available here.

Comments

Michael Stephens | June 11, 2012

An update on the distressing state of fiscal and monetary policy in the United States and Europe:

Chairman of the Federal Reserve to Congress: “I’d be much more comfortable, in fact, if Congress would take some of this burden from us ….”

Congress to Bernanke: No thanks. And while we’re on the subject, we would be much more comfortable, in fact, if you’d just stop carrying the load entirely. Kindly leave the economy in the ditch right there. Or as Binyamin Appelbaum put it in his NYTimes report:

Republicans on the committee pressed repeatedly for Mr. Bernanke to make a clear commitment that the Fed would take no further action to stimulate growth. “I wish you would look the markets in the eye and say that the Fed has done too much,” Representative Kevin Brady of Texas told Mr. Bernanke. Democrats, by contrast, inquired politely after the Fed’s plans and showed surprisingly little interest in urging the Fed to expand its efforts.

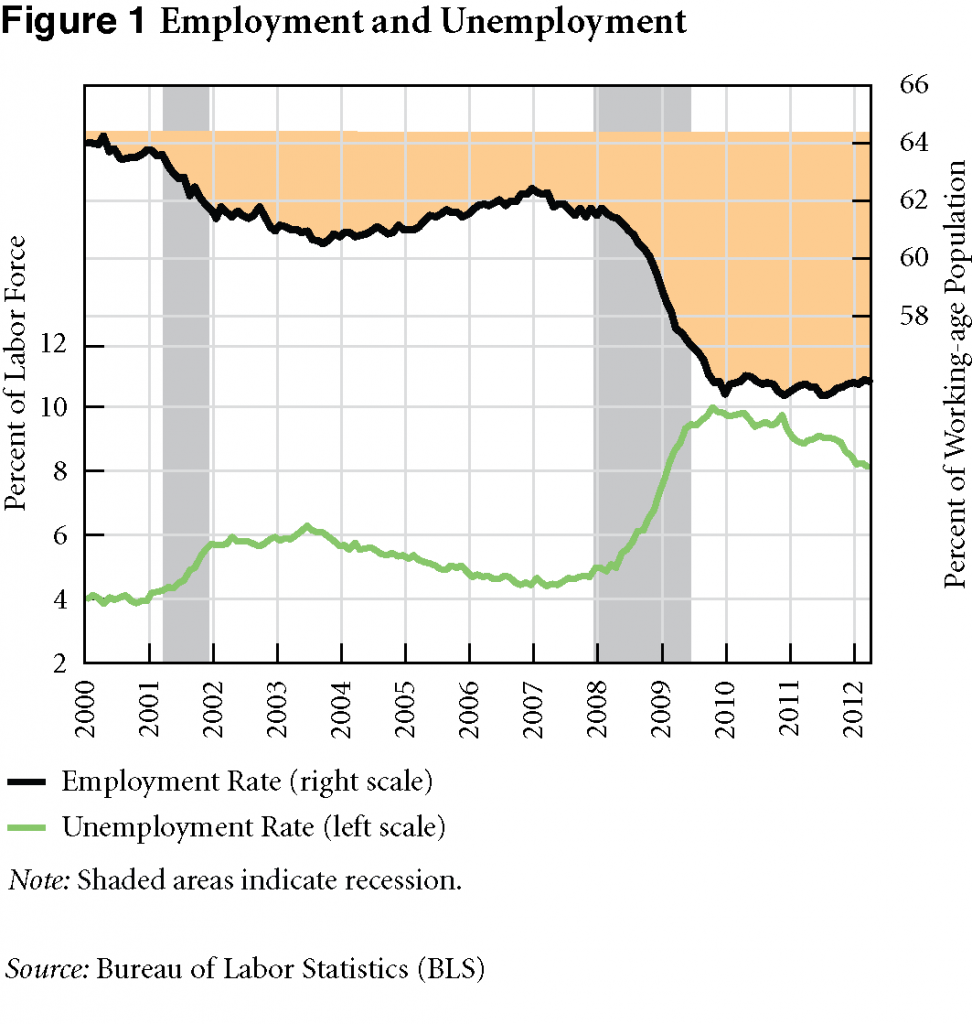

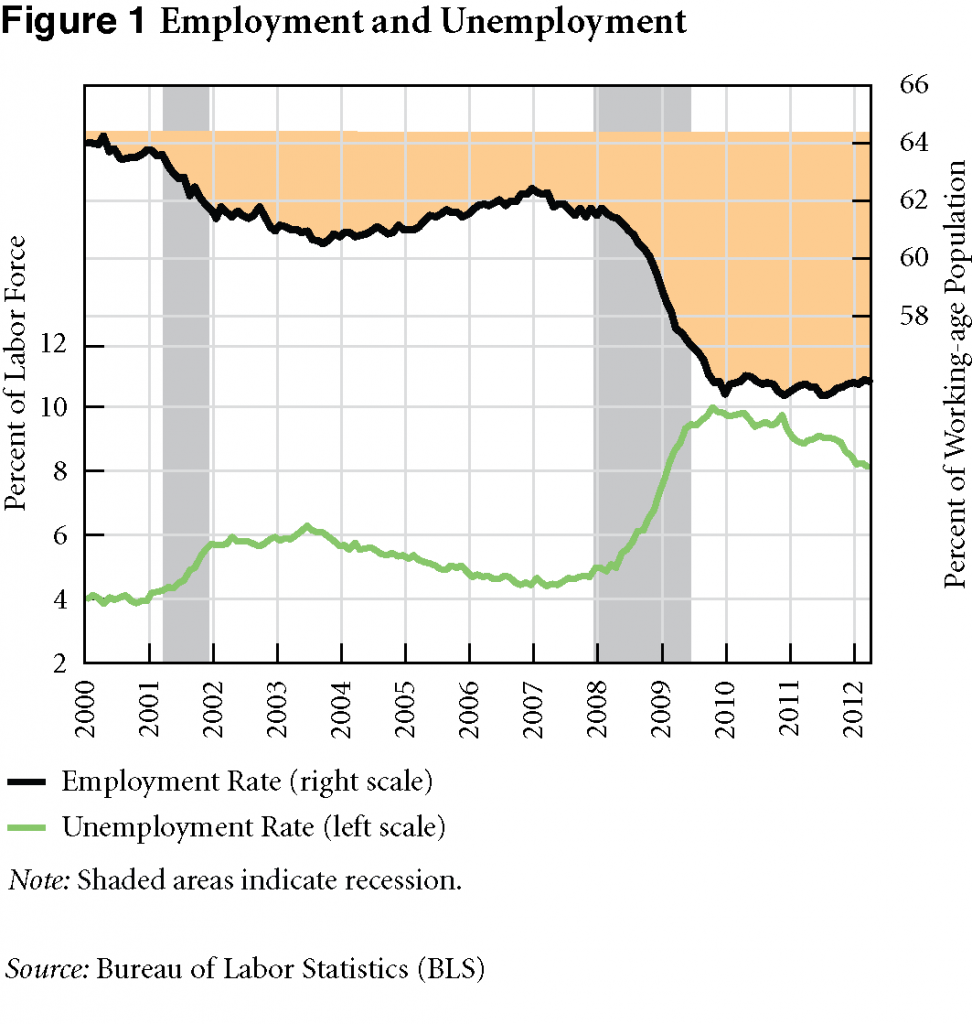

Perhaps the private sector can muddle through on its own? Here’s a graph from the Levy Institute’s Strategic Analysis showing employment and unemployment rates going back to 2000:

To fill the gap in the employment rate represented by that orange area, according to the macro team “the nation needs to find jobs for about 6 percent of the working-age population, or roughly 15 million people. Since the working age population has been growing on average by 2.4 million people per year, or 205,000 each month, job creation that barely reaches a threshold of that number multiplied by the current employment-population ratio of about .59 will not narrow the gap.” Last month the economy generated an estimated 69,000 new jobs. You don’t need your calculator to figure out that won’t narrow the gap.

And how are things in Euroland? continue reading…

Comments

Michael Stephens | June 8, 2012

After the news broke of his firm’s (now $3 billion) loss on a hedge gone awry, Jamie Dimon quipped: “just because we’re stupid doesn’t mean everybody else was.” Stupidity, however, is beside the point.

Jan Kregel has pointed out how a lot of the discussion surrounding this episode is designed to give the impression that this was just a matter of personal folly and bad judgment. Get rid of a few people, tweak a model, and everything should be fine. But there’s far more to this story, says Kregel in a new policy note. First, the fact that management appeared not to recognize what was going on in a unit that reported directly to them suggests that JPMorgan was too big to manage. And if it’s too big to manage, it’s too big for regulators to supervise effectively.

But simply making banks smaller won’t solve the problem either, according to Kregel—not if they’re allowed to engage in the same kinds of trades on the same kinds of assets. Here he captures the “heads they win, tails we lose” dynamic of the post-Gramm-Leach-Bliley banking world:

[S]ince the passage of the Gramm-Leach-Bliley Act in 1999, the major activity of banks is to profit from changes in the prices of the assets held in its trading portfolio—and for JPMorgan Chase, in its hedging of its global portfolio. This activity generates little new investment and virtually no employment. If the bank guesses right, it makes capital gains for its shareholders; if it guesses wrong, and other banks have made the same guesses, the government and the general public are called upon to bear the losses. The problem is not simply that the banks are too large; it is that they generate shareholder returns by betting on changes in asset prices in their portfolios rather than by betting on investments in real productive activities that create income and employment for the economy as a whole.

The last line here is fundamental. Dodd-Frank approaches the regulatory challenge by trying to make banks’ trading activities less risky. But risk alone is not the issue for Kregel. The problem isn’t simply speculation or riskiness per se, but that “they are engaging,” he says, “in the wrong kinds of investments and the wrong kinds of risks.” What Dodd-Frank fails to do is to reorient the banking system from speculating on price changes in exotic assets toward speculating on the real economy: on the ability of entrepreneurs to identify and pursue business opportunities that generate employment and real output.

Read it here.

Comments

Greg Hannsgen | May 30, 2012

You wonder what will happen when markets finally start working. How about, for example, a market that changes prices and wages quickly in response to fluctuations in demand? In a mixed economy with a government that tries to provide fiscal stimulus as needed, will it be of help to move toward such fast-adjusting markets? The two interactive diagrams in this post are based on figures 9a, 9b, 10a, and 10b in a Levy Institute working paper of mine called “Fiscal Policy, Unemployment Insurance, and Financial Crises in a Model of Growth and Distribution,” which was issued just this month and posted on the Institute’s site (math content somewhat crucial).

Each of the two figures shows one pathway followed by an imaginary economy. The pathways are computed by simulating a heterodox model, using a set of parameters as well as a starting point for each of the following variables: capacity utilization, public (government) production, the markup on labor costs used by businesses to calculate their prices, and the size of the labor force. As I explain in the paper, my parameter choices are not based on econometric estimates, but rather on a rough sense of what might be reasonable for a developed economy. In a moment, a new technology will give you a chance to see the impact of varying one of these assumed numbers. In fact, this post represents the first use on this blog of Wolfram’s interactive cdf format. You’ll need a free cdf reader and browser plug-in, which are downloadable at this link, if you don’t already have them.

The pathway shown in the figure just below is followed by public production, capacity utilization, and the markup. As shown, the pathway leads gradually upward in the figure toward an endless orbit called a “limit cycle.” The stabilizing effects of fiscal policy seem to be creating a steady, repeated elliptical pattern.

[WolframCDF source=”http://blogs.bard.edu/multiplier-effect/files/2012/10/blog-cdf-1-revised.cdf” CDFwidth=”435″ CDFheight=”468″ altimage=”http://blogs.bard.edu/multiplier-effect/files/2012/10/blog-cdf-1-alternative-image-rev.png”]

Now, move the lever above the diagram to the right by clicking and dragging with your mouse (or similar move with a touchpad or whatever hardware you have). As you move the lever to the right, you are increasing a parameter that controls the speed at which the markup changes in response to high or low levels of customer demand. continue reading…

Comments

Michael Stephens |

News sections are littered with shortcuts for explaining what’s going on in the eurozone, often featuring easy, morally sodden narratives. But the real problem here is not that narratives and other shortcuts are being employed—after all, sometimes the data need a little help. The real problem is that they’re using the wrong narratives.

We’re told more often than not that the reason peripheral countries like Spain are in trouble is that their governments engaged in an irresponsible spending binge and are now reaping the consequences. But in 2007 Spain’s debt-to-GDP ratio was low—a quaint 27 percent of GDP—and had been falling for some time. Likewise, by contrast with the Aesop-flavored conventional wisdom, German ants work 690 fewer hours per year compared to their Greek grasshopper counterparts. But this doesn’t mean morality has no place in an assessment of Europe’s economic woes. Today, for instance, the imposition of austerity and the waste of human potential this is generating—even as austerity fails to summon the “confidence” and growth that was promised and fails to make a significant dent in debt-to-GDP ratios—begs for moral judgement.

And while a technical analysis of the basic setup of the EU and all the imbalances it has generated can get you most of the way toward explaining what’s going on (take a look at the private debt ratios displayed in this graph), this doesn’t mean that domestic political considerations in the peripheral countries haven’t played a part.

But the problem, again, is that the conventional story you’ll find in the press (profligate southern European governments coddling their workers) is problematic. The parts of the EU that are regarded as being in the least amount of trouble also feature some of the more generous social welfare supports. And as C. J. Polychroniou observes in a new policy brief, social democracy of the northern European variety never really took root in southern Europe. Instead, Polychroniou argues, in countries like Greece, Spain, and Portugal, even the left-leaning parties tacitly accepted a neoliberal path, ushering in comparatively regressive policies over the last several decades, including the privatization of public assets and an underinvestment in education and human services (on the whole, public expenditures in these countries are less generous than the EU average). This, combined with political cultures that rely heavily on clientelism, is part of the reason why southern Europe is where it is, according to Polychroniou: regressive policies failed to deliver sustainable growth and have made a bad structural situation even worse.

Comments

Michael Stephens | May 25, 2012

A little while back the Wall Street Journal observed that if there were as many people employed by government today as there were in the last month of George W. Bush’s tenure, the unemployment rate would be around 7.1 percent. Job creation policy, in other words, can sometimes be quite simple. Step One: stop firing so many people.

Reuters’ Edward Hadas picks up Pavlina Tcherneva’s research on the reorientation of fiscal policy and points us in the direction of a Step Two: offer a job to anyone who wants to work but can’t find paid employment. Tcherneva’s research reveals that the standard way of doing fiscal stimulus, trying to boost economic growth with traditional pump-priming and hoping that the jobs follow, has it backwards. Instead of the traditional “trickle-down Keynesian” approach, Tcherneva suggests that targeting the unemployed with direct job creation policies that run throughout the business cycle would be far more efficient. Tcherneva envisions a direct job creation program that would function as a more effective automatic stabilizer, expanding in recessions and contracting in booms.

She argues that this “bottom up” approach is not only closer to what Keynes actually advocated, but that it is also more likely to bring us back to full employment—while being less inflationary and more equitable. Although expanding government payrolls for projects fulfilling various public purposes would be one way of accomplishing this, Tcherneva advocates using social enterpreneurs and the nonprofit sector to offer jobs to all those willing and able to work (with funding provided by government).

From the standpoint of an ongoing debate about counterfactuals and whether the Federal Reserve would have allowed a more aggressive fiscal stimulus to take effect, one intriguing aspect of Tcherneva’s research stems from her finding that direct employment policies tend to be less inflationary, suggesting that reorienting fiscal policy in this direction might be able to get us closer to full employment before triggering a reaction from the Fed.

The article Hadas cites from the Review of Social Economy is behind a paywall but Tcherneva’s previous working papers on this topic can be downloaded here. Her newest working paper is here.

Comments

Michael Stephens | May 24, 2012

Whether or not you already know what a “repo” is, Public Citizen’s new report on repurchase agreements, which played a part in the recent financial crisis (as well as the collapse of MF Global), is well worth reading. Here’s their introduction:

In the run-up to the 2008 financial crisis, banks depended increasingly on an unreliable method of funding their activities, called “repurchase agreements,” or repos. Repos may look like relatively safe borrowing agreements, but they can quickly create widespread instability in the financial system. The dangers of repos stem from a legal fiction: despite being the functional equivalent of secured loans, repo agreements are legally defined as sales. Dressing up repo loans as sales can lead to sloppy lending practices, followed by sudden decisions by lenders to end their risky lending agreements and market panics. Repos also permit financial institutions to cover up shortcomings on their balance sheets. The problems in the repo market were exposed as the 2008 financial crisis unfolded, yet the risks posed by repos remain largely unaddressed. Without reform, the financial system will remain susceptible to the sudden and severe shocks that repos can cause.

Micah Hauptman and Taylor Lincoln have also written a blog post that runs down some of the basics.

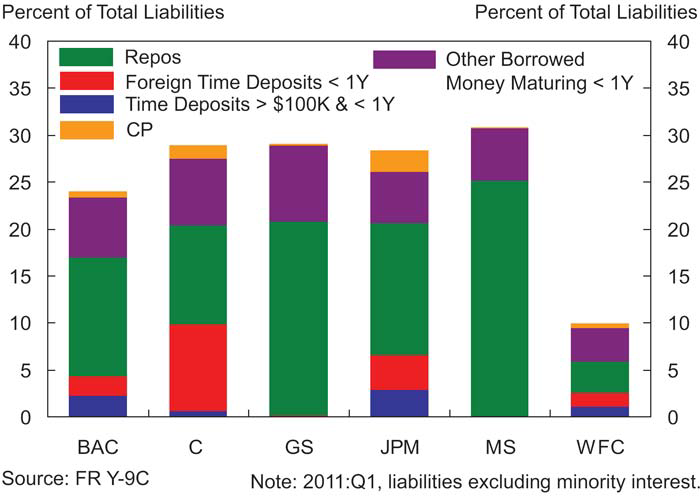

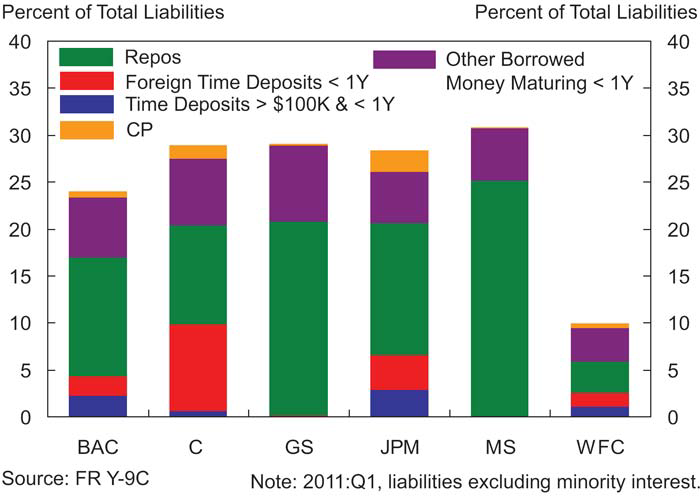

In their report, Public Citizen uses data from the Financial Stability Oversight Council (FSOC) that displays how heavily repos are (still) being used among the top six bank holding companies. This figure shows the percentage of the liabilities held by the biggest banks that are deemed “less stable” by FSOC. As you can see, repos (in green) represent the largest chunk:

Source: Financial Stability Oversight Council Annual Report (2011)

Source: Financial Stability Oversight Council Annual Report (2011)

The Public Citizen report also includes a brief history of the regulatory changes that enabled repos to play a role in the financial crisis. continue reading…

Comments

Michael Stephens |

There is no shortage of viable economic solutions for the eurozone. But as Martin Wolf points out in his FT column, once you strike all of the solutions that have been declared politically unacceptable (eurobonds, a stronger EU-level fiscal authority), there aren’t too many policy levers left to pull. One possibility Wolf mentions is to encourage faster adjustment within the eurozone by allowing higher inflation in the core (Germany) than in the periphery—but Germany is unlikely to accept that either.

Instead, we’re left with trying to achieve adjustment through internal devaluation (declining wages in the periphery). How’s that going? C. J. Polychroniou checks in on the progress in his latest one-pager:

The “internal devaluation” policy pursued by Germany, the European Central Bank, and the European Commission can be summed up in a few words: great pain, no gain. The irony of this seems not to have escaped the attention of the Brussels bureaucrats: the Commission’s spring economic forecast, released just a few days ago, observes that “wages in the business sector have been falling in recent quarters but at a pace that was insufficient to help recover competitiveness.” Still, the report injects a note of optimism by stating that “the recent labour market measures are expected to contribute to further significant reductions in labour costs over the next two years.”

…

The Commission also acknowledges that the “current-account deficit . . . remains at an unsustainable level.”

Polychroniou also assesses what the emergence of Syriza means for the future of Greece and eurozone negotiations. Read it here.

Comments

Michael Stephens | May 22, 2012

Yanis Varoufakis and Stuart Holland have updated their “Modest Proposal” for overcoming the eurozone crisis (they call it version 3.0). They took on the challenge of coming up with proposals for addressing the eurozone’s tripartite crisis (sovereign debt, banking, and underinvestment) in a way that avoids any treaty changes or the creation of new EU institutions. So although turning the eurozone into a “United States of Europe,” with an empowered federal (which is to say EU)-level fiscal authority and a central bank willing and ready to act as a buyer of last resort for government debt might be an ideal solution, there are serious institutional and political obstacles that stand in the way.

These are the three constraints Varoufakis and Holland accepted as fixed elements of the EU’s policymaking landscape:

(a) The ECB will not be allowed to monetise sovereigns directly (i.e. no ECB

guarantees of debt issues by member-states, no ECB purchases of

government bonds in the primary market, no ECB leveraging of the EFSF-ESM

in order to buy sovereign debt either from the primary or the secondary

markets)

(b) Surplus countries will not consent to the issue of jointly and severally

guaranteed Eurobonds, and deficit countries will not consent to the loss of

sovereignty that will be demanded on them without a properly functioning

Federal Europe

(c) Crisis resolution cannot wait for federation (e.g. the creation of a proper

European Treasury, with the powers to tax, spend and borrow) or Treaty

Changes cannot, and will not, precede the Crisis’ resolution.

(The updated version alters the third prong of their proposal, which involves using the European Investment Bank and European Investment Fund to address the growth and underinvestment crisis.)

Comments

Michael Stephens | May 21, 2012

In an interview with Helen Artopoulou that was posted on Capital.gr, Levy Institute president Dimitri Papadimitriou discusses the failure of the austerity policies imposed on Greece and the uncertain future of the euro project.

Q. The political impasse in Greece, largely the outcome of the recent elections, had led to some reconsideration of the austerity policy measures being currently implemented in the indebted countries of the Eurozone. In fact, it seems that a number of public officials have shifted their position, calling now for a growth-oriented economic policy. Given the reality of Greece, how easy is to stir economic growth, and why didn’t the EU follow the growth path to economic recovery in the first place but relied instead on fiscal consolidation and draconian austerity measures?

Economic growth is dependent on public policy aiming at deploying the resources available, that is, labor and capital. Presently, in Greece, there is an abundance of labor, but no capital from either the private or public sectors. It will be some time before the economy becomes friendlier to private investment, markets offering increasing liquidity, and for the private sector to gain confidence in the country’s economic stability. The time horizon for these things to happen will be long so, the responsibility falls on the public sector to do the investing in the key sectors of the Greek economy. But the public sector is on the brink or bankrupt, and in effect restricted by the EU, ECB and IMF in investing for growth. When they call for a growth-oriented economic policy in response to the overwhelming election results in favor of the anti-austerity platform, they simultaneously insist on the implementation of the imposed austerity. This joint policy prescription, that growth and austerity can coexist, is the new “austerian” economics—a new frontier of economic nonsense. North European leaders believe that all member states in the Eurozone can be similar to Germany’s competitive export-led growth economy. But Germany’s competitive advantages that yield intra Eurozone better trade balances are dependent on other Eurozone’s countries worse balances.

Austerity programs were imposed, first, to discipline the eurozone’s profligate citizens and, second and most importantly to calm the financial markets, both of which have failed miserably. The medicine of austerity has worsened the patient’s condition and markets, as has been observed time and time again, have a mind of their own.

Q. Greece is facing once again the prospect of a forceful exit from the eurozone. How likely is this frightening scenario and is it manageable? Also, would it be as disastrous for the country as most people fear it would be?

Read the whole thing here.

Comments

ShareThis

ShareThis