Michael Stephens | July 11, 2012

When the European Monetary Union was set up, member-states adopted what was essentially a foreign currency (the euro) but were left in charge of their own fiscal policy. Dimitri Papadimitriou and Randall Wray explain in a new Policy Note (“Euroland’s Original Sin“) why this basic structural defect was always bound to tear the eurozone apart. The solvency crises and the bank runs afflicting Spain, Greece, and Italy were entirely foreseeable (and as Papadimitriou and Wray point out, entirely foreseen). Unless something is done to remedy this design flaw, the EMU will continue to crumble.

The banking crises laid bare what happens when you try to separate fiscal policy from a sovereign currency: “banks were freed to run up massive debts that would ultimately need to be carried by governments that, because they had abandoned currency sovereignty, were in no position to bear the burden,” say Papadimitriou and Wray. Inasmuch as they are users rather than issuers of a currency, EMU nations are essentially in the same position as US states—but the difference is that US states can rely on the currency-issuing firepower of the federal government (when Texas was hit with the S&L crisis in the 1980s, the federal government picked up the tab; a tab that was about one quarter the size of Texas’ entire GDP). And the problem is not just the size of the debts member-states took on, but that they took them on without the benefit of controlling their own currency—which makes all the difference in the world. The US and Japan can borrow at very low rates while countries like Spain (whose debt ratios are much, much smaller than those of Japan) are caught in a vicious cycle of rising borrowing costs.

Papadimitriou and Wray explain how all of this was compounded by the TARGET system, which made possible the massive bank runs in Spain, Greece, and Italy. They argue that EMU-wide deposit insurance backed by the creation of a strong EU-level treasury is necessary. There was some initial enthusiasm (as there always is, initially) when the latest “solution” emerged from the June 29 summit. But it is becoming clear that the EMU is not moving towards a true banking union* anytime soon.

Read the whole Policy Note here.

* The term “banking union” is being thrown around a lot, but there’s a difference between giving the ECB extra supervisory powers over the banking system and moving to unlimited deposit insurance, which, as of yet, does not appear to be on the horizon. A similar confusion can arise with the term “fiscal union”: rather than the creation of a strong European federal treasury, the term is commonly used to refer merely to the new fiscal accord in which member-states will face stiffer penalties when they violate the Maastricht criteria limits on deficits and debt. The only “union” that will remedy the structural error built into the EMU is one that addresses the doomed separation between fiscal policy and currency sovereignty.

Comments

Greg Hannsgen | July 10, 2012

As the Center on Budget and Policy Priorities (CBPP) has reported in several recent postings, cuts to SNAP—formerly known as the food stamp program—now being considered in Washington would impose severe hardship on millions of people who use SNAP benefits to buy groceries in retail stores. For example, the Center released a report a few days ago on cuts to the program contained in the farm bill recently proposed by House Agriculture Committee leaders. These three points, quoted from the report, summarize the impact of the proposed cuts:

- The bill would terminate SNAP eligibility to several million people. By eliminating categorical eligibility, which over 40 states have adopted, the bill would cut 2 to 3 million low-income people off food assistance.

- Several hundred thousand low-income children would lose access to free school meals. According to the Congressional Budget Office (CBO), 280,000 children in low-income families whose eligibility for free school meals is tied to their receipt of SNAP would lose free meals when their families lost SNAP benefits.

- Some working families would lose access to SNAP because they own a modest car, which they often need to commute to their jobs. Eliminating categorical eligibility would cause some low-income working households to lose benefits simply because of the value of a modest car they own. These families would be forced to choose between owning a reliable car and receiving food assistance to help feed their families.

(The Ryan budget would lead to even larger cuts, as this report shows.) As a macroeconomist, I tend to be in favor of government programs that automatically increase in size as the economy falls into a recession. Of course, such programs help to maintain spending when households and/or businesses suffer a setback due to a financial crisis or some other macroeconomic problem. Many of these programs have the added advantage that they focus on the most adversely affected individuals. They are aimed at providing people with the most basic essentials. They reduce the need for ad hoc “stimulus bills” during recessions. Finally, they are known for achieving an especially high level of “bang for the buck,” as a form of fiscal stimulus, because they go mostly to individuals who spend almost all of their small-to-modest incomes. (An employer-of-last-resort program would represent perhaps the “alpha and omega” of such automatic-stabilizer programs.)

The proposed cuts would fall on a program that has grown rapidly in recent years. continue reading…

Comments

Michael Stephens | July 2, 2012

A few months ago we wondered why it was that business groups hadn’t been pushing harder for more stimulus. My proposed (unoriginal) explanation had to do with inequality and decoupling; Paul Krugman suggested social pressures might also play a part. But as it turns out, there’s another answer: they are pushing! The National Association of Manufacturers (NAM) recently endorsed expanding a government program with the intent to directly and indirectly create one million jobs.

Bruce Bartlett (former Treasury Secretary in the Reagan administration) highlights the fact that the influential NAM has released a report detailing how the defense spending cuts scheduled for 2013 as a result of the Budget Control Act (the debt ceiling deal from last summer) will harm employment and growth. So technically this isn’t really an example of pushing for more stimulus; we’re just talking about preserving levels of funding and preserving jobs. But the logic of the NAM position goes a long way.

For instance, they argue that the knock-on effects of restoring the public spending cuts would create a substantial net number of jobs in the private sector. In other words, they have implicitly abandoned the argument that increasing government spending or public job creation (above scheduled 2013 levels) would “crowd out” private spending and job creation, embracing instead some version of a multiplier effect. And if you follow the NAM that far, what reason is there to assume that we’re currently sitting (which is to say, before the Budget Control Act cuts take effect) right at some optimal level of spending and employment beyond which a direct job creation program would no longer be effective?

And if increasing defense production is deemed a worthy investment of public resources, why not early childhood education or environmental renewal? Mathew Forstater presented at the Levy Institute’s Minsky Summer Seminar on the concept of an employer-of-last-resort (ELR) program that would fund community organizations to hire anyone willing and able to work at a “green job.” The program would address our current unemployment crisis and, because it’s designed to operate at all phases of the business cycle, the failure to reach full employment, all while helping tackle environmental challenges. (A recent working paper by Antoine Godin does some modeling of the likely effects of a green jobs ELR.) continue reading…

Comments

Michael Stephens | June 26, 2012

Alan Greenspan is apparently writing a book to determine why economic models (all of them, he says) failed to sniff out the financial crisis and ensuing recession. “While the models themselves capture the nonfinancial part of the economy rather well,” says Greenspan, “they’ve been wholly inadequate in understanding how the complex financial system works, both in the United States and globally.”

As it happens, the Levy Institute’s Hyman P. Minsky Summer Seminar just finished up, and last week Gennaro Zezza presented on the stock-flow consistent model used here at the Institute. The approach embedded in this model, originally inspired by Wynne Godley and still being refined and expanded, is notable for the manner in which it looks at the relationship between finance and the real economy. For an explanation of its contours and to see how it differs from some of the more orthodox models Greenspan presumably has in mind, this paper by Zezza (“Fiscal Policy and the Economics of Financial Balances”) is a good place to start. As the paper illustrates, the model has had a pretty good track record.

Godley and Marc Lavoie’s “Monetary Economics” (recently discussed by Lavoie in a two–part interview with Philip Pilkington) describes some of the early challenges with obtaining good data on the financial flows that are part of this approach (pp. 24-25). But as Godley and Lavoie wrote, “[t]he problem now is not so much the lack of appropriate data … but rather the unwillingness of most mainstream macroeconomists to incorporate these financial flows and capital stocks into their models, obsessed as they are with the representative optimizing microeconomic agent.”

Comments

Michael Stephens | June 25, 2012

Brad Plumer reports that a Texas-based bank and a pair of conservative advocacy groups have filed suit against the Consumer Financial Protection Bureau, claiming that the agency is unconstitutional (the agency was created by the Dodd-Frank Act and was a longtime cause of senatorial candidate Elizabeth Warren, who had a hand in setting it up).

Normally, this is the sort of story that wouldn’t merit a pause. But given the fact that we’re now patiently waiting for the Supreme Court to rule on the constitutionality of the Affordable Care Act (“Obamacare”), with many expecting that the Court will strike down some portion of the law—a scenario very few people took seriously when the law passed—anyone interested in financial regulatory reform should probably start paying attention to this lawsuit. (Plumer has posted a copy of the suit, which also targets FSOC, the Financial Stability Oversight Council.)

Despite the numerous flaws in the regulatory approach taken by Dodd-Frank, many of which have been highlighted by Levy Institute scholars (see, for instance, here, here, and here), Randall Wray and Yeva Nersisyan argued (in a paper written when the law was being put together) that the idea of the CFPB was “the best part of the proposal put forward by Washington.”

According to a CFPB spokesperson cited by Plumer, “this lawsuit appears to dredge up old arguments that have already been discredited.” Stand ready for those old arguments to be given new life. And be on the lookout for some shiny new arguments, likely of the slippery slope variety; preferably involving a cruciferous vegetable.

Comments

Greg Hannsgen | June 21, 2012

In my last post, I quoted Joan Robinson, the renowned Cambridge University economist, on the determinants of long-term interest rates. The mention of Robinson was made in the context of a comment on the Fed open market committee meeting earlier this week and Chairman Ben Bernanke’s press conference on Wednesday. For those who might be curious, here is the “cheap money” scenario from Robinson that I mentioned in the earlier post; astute readers will notice parallels in recent Fed history:

The first move in the campaign is for the Central Bank to dose the banks with cash, by open market purchases. The amount of advances the banks can make is limited by the demand from good borrowers. The demand is very inelastic (though it shifts violently up and down with the state of trade), so the banks, between whom competition is highly imperfect, see no advantage in cheapening their price. The redundant cash reserve must go into bills. Any rate of return is better than none. The banks with redundant cash find themselves in much the same position as a group of firms with surplus capacity and zero prime costs. If perfect competition prevailed, the bill rate would go to next to nothing and the banks could not cover their costs. They therefore fix up a gentlemen’s agreement which keeps the bill rate steady at a low level. The bill rate is maintained at this low level by the Central Banks giving another dose of cash whenever it threatens to rise.

If the Central Bank is operating in the old orthodox manner, its power ends here, and the authorities must rely on the dealers in credit to bring the long rates down. Nowadays the authorities reinforce the action of the banking system by going into the bond market directly. If necessary, they issue bills in order to buy bonds, the quantity of money being adjusted to whatever level is required to keep the bill rate at its bottom stop. The low interest rates may slow down the velocity of active circulation so that money, as the saying is, stagnates in pools. Long hoards are swollen by the fall in current rates and bear hoards by the fact that expected future rates are not yet revised.

As time goes by, experience of a long rate that is persistently somewhat lower than the expected rate lowers the expected rate and so lowers the actual rate further. The yield on shares falls in sympathy with the bond rate. Thus the whole complex of rates gradually falls through time. If the authorities take it gently and do now try to push the rate down too fast, and if they stick consistently to the policy, once begun, so that the market never has the experience of today’s rate being higher than yesterday’s, it is hard to discern any limit to the possible fall in interest rates (except the mere technical costs of dealing) so long as the full-employment interest rate is below the actual level of rates or is held below it by a budget surplus or other means.

Joan Robinson, in “The Rate of Interest” (1951) from The Generalization of the General Theory and Other Essays, published by St. Martin’s Press, New York, 1979, pages 163–64. (The date of the original article was stated as 1952 in my earlier post; that is the publication date of the first edition of the book, which appeared under the title The Rate of Interest and Other Essays. My apologies for any inconvenience caused by this error.)

Comments

Greg Hannsgen | June 20, 2012

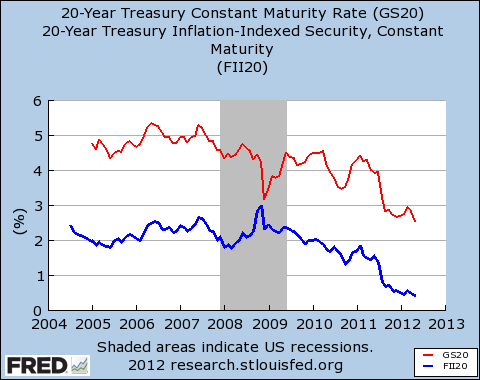

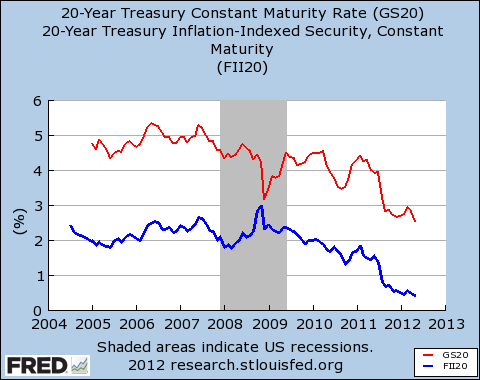

As I write, markets are wondering what Fed Chairman Ben Bernanke will say about interest rates in a press conference taking place this afternoon. Many economists, including some on the Federal Reserve’s rate-setting committee, are arguing that the Chairman is courting inflation with his policies of keeping interest rates low. He has been using three main approaches to this task:

(1) keeping short-term interest rates low through open market operations;

(2) buying and holding medium- and long-term bonds in a direct bid to keep longer-term rates low; and

(3) saying that it is likely to keep the federal funds rate near zero for an extended period of time.

Task (1) has been the usual approach of the Fed in modern times (since the early 1950s perhaps); task (2) has been important since the Fed’s response to the financial crisis beginning in 2008 or so. The current version of task (2) consists largely of a “twist” operation in which short-term securities are sold to pay for purchases of long-term securities. Task (3) is a commitment of sorts about short-term rates that helps to keep longer-term rates down. Tasks (2) and (3) are the most directly relevant to mortgage and auto loan rates, which are longer-term rates.

Economists, including critics of the Fed’s expansionary policies, sometimes refer to this three-pronged approach as a “cheap money policy,” but many who oppose “cheap money” have claimed that it would not be possible to maintain such a policy for very long (economic laws, or perhaps the bond markets’ worries about future inflation, would prevent this).

In a 1952 essay, Joan Robinson argued that a modern central bank could achieve a low long-term interest rate, but that it would take a long time to do so, in comparison to the quasi-real-time control the Fed enjoys over the federal funds rate. continue reading…

Comments

Michael Stephens | June 19, 2012

Slate‘s Matt Yglesias nicely captures the gap between the reactions of opinion-makers to the Greek election results and the reactions of markets (Sunday’s electoral results point to a coalition government centered around New Democracy and Pasok): “Markets were supposed to be reassured. Instead they’re freaking out. European stock markets are declining, and Spanish bond yields are back into the 7 percent danger zone. What went wrong? Perhaps the better question to ask is how it ever got to be conventional wisdom that maintaining the Greek status quo was the reassuring option?”

A Greek exit from the eurozone is still very much a live possibility. And given that the election results represent a continuation of the status quo, you might say a Grexit is even more likely. If you believe the status quo is unsustainable, and that only something like a Greek New Deal would bring the growth necessary to pull Greece out of its depression, then there is little room for optimism. So what would a Greek exit actually look like? C. J. Polychroniou tackles this question in a new policy note.

Polychroniou argues that it was a mistake not to allow Greece to proceed with an orderly default two years ago. While Greece is in for some economic pain whether it stays on the euro or returns to the drachma, it would, he argues, be better off in the latter scenario given a well-worked-out strategy for an orderly default (which is to say, better off compared to being continuously “rescued” with what are essentially bailouts of the EU’s banks attached to austerity directives, leaving Greece with the doubtful task of substantially reducing its debt-to-GDP ratio while shrinking its economy). Polychroniou’s assessment of the relative costs of a Greek exit is based in part on his reading of the background political conditions:

The gloom-and-doom scenario involves a disorderly default on Greek government debt and assumes that Greece will be completely cut loose. This scenario essentially removes all political considerations from the picture and is highly unlikely to happen. It is a scenario much closer to a Hobbesian “state of nature,” when a Machiavellian outcome is far more probable. Indeed, a more likely scenario is that the Grexit will be orderly (the German Ministry of Finance and virtually all major banks,

including the ECB, have already made contingency plans), and that both the EU and the IMF will become involved in damage control.

Read it here.

Comments

Michael Stephens | June 18, 2012

This received little attention, but President Obama recently sat down for an interview with Mark Halperin of Time magazine. The interview didn’t generate anything you might call “newsworthy,” littered as it was with tired exchanges like this one:

Q: “Why not in the first year, if you’re [re-]elected — why not in 2013, go all the way and propose the kind of budget with spending restraints that you’d like to see after four years in office? Why not do it more quickly?”

A: “Well because, if you take a trillion dollars for instance, out of the first year of the federal budget, that would shrink GDP over 5%. That is by definition throwing us into recession or depression. So I’m not going to do that, of course.”

No, of course not. There isn’t anything surprising about this response, with the President mechanically delivering the Keynesian line. But it does reinforce something about this election: that it’s shaping up to be a battle between contrasting visions, Keynesian vs. Austerian, and a referendum on the President’s implementation of his preferred Keynesian approach. That’s what will make this election so satisfying for anyone interested in economic policy and what makes it a rare occasion for the public to deliver their verdict on the last few years’ worth of Keynesian management, and to decide if they want to move in a different direction.

Except that’s all false. That’s not what this election is about—not at all.

The exchange quoted above is actually taken from an interview of Republican presidential nominee Mitt Romney. It’s Romney who is explaining in a matter-of-fact, offhand way that reducing the deficit in the short term would be disastrous for the economy. It’s Romney embracing the Keynesian argument.

This election may be about optimal tax rates for the wealthy and the long-term size of government (or more accurately, the size of government programs serving the poor), but it is not, as Romney’s unguarded moment demonstrates, about competing visions of short-term macroeconomic management. Instead, it’s a battle of pretend visions—of economic policy, of the way the political system works, and of fiscal reality. continue reading…

Comments

Greg Hannsgen | June 15, 2012

On the topic of public policy, this Works Progress Administration (WPA) poster from the 1930s seems particularly relevant this year. You may have heard of the “fiscal cliff” that the federal budget will fall off in January, under existing law. It will be quite a fiscal contraction, if it happens as scheduled: about 4 percent of last year’s GDP, to use these numbers from the Congressional Budget Office (CBO). This total includes both tax increases and spending cuts, but not the offsetting effects of “automatic stabilizers,” such as lower income taxes for people whose incomes are adversely affected by the cliff itself. The CBO report projects that this set of changes would lead to a recession early next year. (Briefly, the changes that make up the cliff are (1) the expiration of the “Bush tax cuts,” the 2 percent payroll-tax holiday, and some other tax cuts; (2) the across-the-board spending cuts broadly agreed to by President Obama and Congress as part of last summer’s deal to raise the debt limit; (3) the end of new emergency extended unemployment benefits; (4) reduced Medicare doctor payment rates; and (5) tax increases included in the “Obamacare” health act passed by Congress in 2010.)

I chose the image at the top of this post out of many available free-of-charge at the Library of Congress’s WPA-poster archive mostly because of its cliff theme (this poster happens to depict a place in the state of New York, perhaps a few hours’ drive from the Institute). But we also hope the image will offer readers some hope—as the WPA did for unemployed artists and others during the 1930s. The White House and many in Congress are working on legislation that may lessen the severity of next year’s fiscal crunch. These important proposals will mostly aim to delay or cancel scheduled changes to spending programs and the tax code. To really tackle the unemployment problem, however, Washington ought to consider a large-scale public-employment program a bit like the WPA. As the website for our employment policy and labor markets research program points out, “Levy Institute scholars have proposed a full-employment, or job opportunity, program that would employ all who are willing to work and increase flexibility between economic sectors…” You might want to take a look at some of the many publications at that website that deal with the potential design and impact of full-employment, direct job creation programs.

Comments

ShareThis

ShareThis